Beynəlxalq agentlik Azərbaycanın kredit reytinqini yüksəltdi

“Moody’s Ratings” Azərbaycanın suveren kredit reytinqini “Ba1” səviyyəsindən “Baa3” səviyyəsinə (investisiya səviyyəsi) yüksəldib. Belə ki, “Moody’s Ratings” Azərbaycanın kredit reytinqini investisiya səviyyəsinə yüksəldib. Reytinq üzrə proqnoz “müsbət”dir.

İyulun 4-də “Moody’s Ratings” beynəlxalq reytinq agentliyi Azərbaycan Respublikasının suveren kredit reytinqini “Ba1” səviyyəsindən “Baa3” səviyyəsinə (investisiya səviyyəsi) yüksəldərək reytinq üzrə proqnozu “müsbət” saxlayıb.

Marja.az Azərbaycan Maliyyə Nazirliyinin yaydığı məlumata istinadən xəbər verir ki, aparıcı üç beynəlxalq kredit reytinq agentliyindən biri olan “Moody’s”in yaydığı məlumatda qeyd olunur ki, yeni reytinq üzrə müsbət proqnoz ölkədə davam etdirilən islahatların fonunda iqtisadiyyatın və fiskal sahənin neft-qaz sektorundan asılılıq gözləntilərinin azalmasını əks etdirir.

Həmçinin, pul-kredit siyasətinin təkmilləşdirilməsi, maliyyə sektorunda tənzimləmələr, dövlət maliyyə idarəçiliyi və ictimai inzibati proseslərdə şəffaflığın artırılması istiqamətində aparılan islahatlar institusional idarəetmənin daha da yaxşılaşacağına əsas verir. Aşağı borc yükü və xalis aktivlərin mövqeyi ilə güclü hökumət balans hesabatı, həmçinin çox yüksək borc ödəmə qabiliyyəti ölkənin güclü tərəfləri olaraq qalır.

Agentlik qeyd edir ki, Azərbaycanın güclü fiskal mövqeyi, möhkəm makroiqtisadi sabitliyin qlobal şoklar və neft qiymətlərinin dəyişkənlik dövründə davamlı olaraq qorunması fiskal dayanıqlığı daha da möhkəmləndirməkdədir. Müsbət proqnoz həmçinin hesabatlılıq sahəsində davam edən potensial inkişafı da əhatə edir. Xarici investisiyaların cəlb edilməsi istiqamətində səylər genişlənir, hüquqi və tənzimləyici çərçivələr üzrə islahatlar davam edir ki, bu da şəffaflıq və hesabatlılığın gücləndirilməsinə kömək edir.

“Moody’s”in qənaətinə görə, Azərbaycanın bölgədə nəqliyyat və yaşıl enerji mərkəzi kimi mövqeyini möhkəmləndirmək yönündə davamlı səyləri nəqliyyat-logistika, tikinti və turizm kimi qeyri-neft sektorlarında davamlı və əhəmiyyətli artımlara imkan verir. Əlverişli coğrafi mövqeyə malik olması və Trans-Xəzər Beynəlxalq Nəqliyyat Marşrutu - Orta Dəhlizdə artan fəaliyyəti logistika sektorunda əlverişli nəticələr yaradacaq və iqtisadiyyatın digər sahələrinə müsbət təsir göstərərək böyük investisiyaları cəlb edəcəkdir. Eləcə də, Qarabağ və Şərqi Zəngəzur bölgələrinin davamlı inkişafı iqtisadiyyatın şaxələndirilməsi istiqamətlərini güclü şəkildə dəstəkləyir. Bütün bu amillər reytinqin yüksəldilməsində təsiredici rol oynayan başlıca amillər kimi çıxış etməkdədir.

Agentliyin ehtimallarına görə, iqtisadiyyatın şaxələndirilməsinə baxmayaraq, Azərbaycan orta və uzun müddətdə neft-qaz gəlirlərindən faydalanmağa davam edəcəkdir. Büdcə transferlərindən asılılığın azaldılması səyləri ilə yanaşı, Dövlət Neft Fondunun aktivlərinin artması fiskal təhlükəsizliyi genişləndirəcək və şok dövrlərində iqtisadiyyata dəstək üçün mövcud olan resursları artıracaqdır.

Qeyd edək ki, “Moody’s Ratings” beynəlxalq reytinq agentliyinin nümayəndələrinin cari ilin 19-21 may tarixlərində Azərbaycana səfəri zamanı aidiyyəti dövlət qurumlarında, o cümlədən Azərbaycan Respublikası Maliyyə Nazirliyində görüşlər keçirilmiş, həmin görüşlərdə aparılan müzakirələr və təqdim olunmuş məlumatlar əsasında reytinq agentliyi tərəfindən ölkənin kredit reytinqi yenidən qiymətləndirilib.

XXX

Moody's Ratings upgrades Azerbaijan's rating to Baa3, maintains positive outlook

Singapore, July 04, 2025 -- Moody's Ratings (Moody's) has today upgraded the Government of Azerbaijan's issuer and foreign currency senior unsecured ratings to Baa3 from Ba1 and maintained the positive outlook. Concurrently, we have upgraded the foreign currency backed senior unsecured rating of Southern Gas Corridor CJSC (SGC) to Baa3 from Ba1 and maintained the positive outlook.

The upgrade reflects improvements in institutional effectiveness, shown in a lengthening track record of maintaining macroeconomic and fiscal stability through recent shocks and oil price swings, which we expect to continue. Progress in regulatory reforms will further enhance banking sector stability, while declining fiscal reliance on hydrocarbon revenues strengthens fiscal resilience. Rapid growth in the transport sector as well as ongoing development of the Karabakh and Eastern Zangezur regions support prospects for further economic diversification. That said, longstanding challenges related to control of corruption, geopolitical risks in Azerbaijan's relationship with Armenia and carbon transition risks remain key constraints to the rating.

The positive outlook reflects our view that ongoing reforms could further reduce economic and fiscal dependence on the hydrocarbon sector beyond our expectations. Moreover, there are prospects for further enhancements in institutional strength and governance amid ongoing reforms to enhance monetary policy transmission, financial sector regulations, public finance management and transparency in public administrative processes.

Azerbaijan's local and foreign currency ceilings have been raised to Baa1 and Baa3 from Baa2 and Ba1 respectively. The two-notch gap between the local currency ceiling and the sovereign rating balances the large footprint of the government in the economy and still weak institutional governance, against ample sovereign wealth assets that support the country's external and macroeconomic stability. The two-notch gap between the foreign currency ceiling and the local currency ceiling takes into consideration the improving but still significant level of dollarization in the economy and the perceived de facto currency peg against the dollar despite a de jure flexible exchange rate regime, which raise the risk of transfer and convertibility restrictions.

Please click on this link https://www.moodys.com/viewresearchdoc.aspx?docid=PBC_ARFTL509518 for the List of Affected Credit Ratings. This list is an integral part of this Press Release and identifies each affected issuer.

RATINGS RATIONALE

RATIONALE FOR THE UPGRADE TO Baa3

REDUCTION OF RELIANCE ON HYDROCARBONS STRENGTHENS ECONOMIC RESILIENCE

Ongoing and effective efforts by Azerbaijan to position itself as a transport and green energy hub allows sustained and significant growth in non-oil sectors such as transport and logistics, construction, tourism and ICT. Greater resilience to fluctuations in hydrocarbon prices and production has supported economic and financial stability through recent shocks and we expect such resilience to continue through potential future shocks.

Azerbaijan's advantageous geographical location at the crossroads of key transport corridors and rising activity across the Trans-Caspian International Transport Route also known as the Middle Corridor will drive robust performance in the transport and logistics sector and attract sizeable investments with positive spillovers across the rest of the economy. Meanwhile, reconstruction efforts in the Karabakh and East Zangezur regions further bolster economic prospects with significant capital investments and construction activity currently underway in the region. The government's renewables push has also attracted foreign investments into wind and solar projects, which could potentially generate additional revenue through export of renewable energy.

INSTITUTIONAL QUALITY STRENGTHENS AMID FURTHER ENHANCEMENTS TO REGULATORY QUALITY

Sustained commitment to reform and proactive management of risks have continued to foster a robust and more resilient banking sector. Since recovering from the oil price-related banking crisis in the middle of the last decade, the Central Bank of Azerbaijan has progressively introduced Basel III standards, stricter limits on foreign exchange exposures, enhanced liquidity requirements, and improved bankruptcy and resolution mechanisms.

As a result, asset quality across the banking sector has continued to improve in recent years, even through a variety of shocks, while high provisions offer significant shock absorption capacity.

As part of the central bank's Financial Sector Development Strategy 2024-26, ongoing reforms include the introduction of a forthcoming manat-denominated liquidity coverage ratio meant to further strengthen liquidity buffers and encourage further de-dollarization. Additionally, new corporate governance standards were progressively introduced over the past 12-18 months across the financial sector, including sector-specific enhancements, with broad themes on actuarial oversight and policyholder protection for insurance companies; client asset protection for investment firms; and credit risk oversight and digital risk management for banks.

ROBUST FISCAL METRICS CONTINUE TO UNDERPIN CREDIT STRENGTH

A strong government balance sheet with a low debt burden and a net asset position, and very high debt affordability remain key credit strengths. As of 2024, sovereign wealth assets held by SOFAZ covered around four times the government's debt and stood at over 80% of GDP, much larger than the approximately 50% level prior to the 2015-16 oil price shock. These fiscal resources limit government liquidity risks, which are modest given low gross borrowing requirements compared to peers.

Effective use of such fiscal buffers during the pandemic allowed for countercyclical spending and limited the deterioration in the government's fiscal and debt metrics. These assets are also denominated in foreign currency and invested primarily in liquid, fixed income securities, providing additional external buffers in supplement to foreign exchange reserves held by the central bank.

Even as diversification progresses, we expect Azerbaijan to continue to benefit from hydrocarbon-related income in the medium to long-term. Along with efforts to reduce reliance on budgetary transfers, we expect further accumulation in SOFAZ assets will widen the fiscal safety net and increase fiscal resources available to provide support for the economy in times of shock.

Fiscal dependence on hydrocarbon revenues has also declined in line with fiscal rules introduced in 2018, which aim to reduce reliance on state budget transfers from the State Oil Fund of Azerbaijan (SOFAZ). Despite a pause during the pandemic shock and adjustment to the rules, transfers as a share of GDP have declined to 10% in 2024 from 16% a decade ago, while the non-oil primary deficit has also declined to 21% in 2024 from 32% in 2018 as a share of non-oil GDP. Given the continued commitment to non-oil fiscal consolidation, we expect further progress in reducing hydrocarbon dependence in fiscal budgeting, fostering greater resilience to oil price volatility along with sustained accumulation in buffers held in SOFAZ. Progress on fiscal reforms has coincided with projects to enhance statistical and fiscal transparency, supported by the International Monetary Fund and the World Bank.

Further reduction in fiscal reliance on hydrocarbon revenues would support further accumulation in SOFAZ assets and allow benefits be more sustainable over future generations as hydrocarbon revenues face longer-term downward pressures from depleting reserves and carbon transition trends. Rising gas production and expanding foreign operations/interests by the State Oil Company of Azerbaijan could mitigate such pressures, but it will take time and further investments to fulfill the oil sector's contribution to the economy.

RATIONALE FOR THE POSITIVE OUTLOOK

The positive outlook reflects the potential for faster progress in diversifying the economy away from hydrocarbon sectors and consolidation in non-oil primary balance than we currently expect, indicating further strengthening of institutional effectiveness and credit resilience to shocks.

The positive outlook also reflects ongoing and potential improvements in corruption and voice and accountability. Efforts to attract foreign investments broaden and reforms of legal and regulatory frameworks are ongoing, which could enhance transparency and accountability. Recent examples include enhancements to corporate governance standards for the financial sector, a new law on arbitration aligned with the United Nations Commission on International Trade Law and digitization of public administration processes such as procurement to minimize avenues for corruption.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE CONSIDERATIONS

Azerbaijan's CIS-4 credit impact score indicates that the rating is lower than it would have been if ESG risk exposures did not exist. This primarily reflects negative exposure to environmental risks, particularly long-term global carbon transition, with moderate exposure to social and governance risks. Its governance profile remains moderately weak, though it is gradually strengthening amid ongoing reforms.

Azerbaijan's E-4 issuer profile score for environmental risk reflects the fact that the economy and government finances remain highly susceptible to a global transition away from hydrocarbon fuels over the longer term. The hydrocarbon sector accounts for around 90% of total goods exports and contributes to around two-thirds of consolidated government revenue. While the government is emphasising economic diversification through its strategic road maps, tangible benefits will take time to materialise and are limited by human capital and institutional constraints.

Azerbaijan's S-3 issuer profile score reflects social risks stemming from still low education and skills attainment, which constrain the development of the labour market, while rising inequality and restrictions on voice and accountability tend to be political flashpoints domestically. That said, the deployment of hydrocarbon revenue on public services including in healthcare, education and social infrastructure help address social concerns.

Azerbaijan's G-3 issuer profile score reflects the ongoing efforts to strengthen policy credibility and effectiveness and the ability of institutions to respond to shocks. However, limited judicial independence and challenges in rule of law, corruption and transparency could constrain prospects for sustained economic diversification and resilience to long-term environmental and social risks.

GDP per capita (PPP basis, US$): 24,984 (2024) (also known as Per Capita Income)

Real GDP growth (% change): 4.1% (2024) (also known as GDP Growth)

Inflation Rate (CPI, % change Dec/Dec): 4.7% (2024)

Gen. Gov. Financial Balance/GDP: 4% (2024) (also known as Fiscal Balance)

Current Account Balance/GDP: 6.3% (2024) (also known as External Balance)

External debt/GDP: 17.8% (2024)

Economic resiliency: ba1

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 01 July 2025, a rating committee was called to discuss the rating of the Azerbaijan, Government of. The main points raised during the discussion were: The issuer's economic fundamentals, including its economic strength, have not materially changed. The issuer's institutions and governance strength, have materially increased. The issuer's fiscal or financial strength, including its debt profile, has materially increased. The issuer's susceptibility to event risks has not materially changed.

FACTORS THAT COULD LEAD TO AN UPGRADE OR DOWNGRADE OF THE RATINGS

FACTORS THAT COULD LEAD TO AN UPGRADE OF THE RATINGS

Upward pressure on the rating could develop if ongoing and further reforms lead to more rapid improvements in governance, transparency, and policy predictability that further strengthen the credibility and effectiveness of institutions and their ability to adjust to long-term challenges. Increasing evidence that diversification efforts will reduce the exposure of the economy and government finances to oil price cycles and long-term carbon transition would additionally put upward pressure on the rating. Material improvements in economic and diplomatic ties with Armenia that reduces risk of a reescalation in geopolitical tensions will also be credit positive.

FACTORS THAT COULD LEAD TO A DOWNGRADE OF THE RATINGS

The positive outlook signals that a rating downgrade is unlikely over the near term. The outlook would likely be changed to stable if there were signs of erosion in the credibility and effectiveness of the enhanced macroeconomic and fiscal policy framework that undermines the ability of institutions to respond to long-term challenges. Heightened geopolitical tensions with Armenia or significant spillovers from regional conflicts that would exert a significant negative impact on economic activity and government finances would also be credit negative.

The principal methodology used in these ratings was Sovereigns published in November 2022 and available at https://ratings.moodys.com/rmc-documents/395819. Alternatively, please see the Rating Methodologies page on https://ratings.moodys.com for a copy of this methodology.

The weighting of all rating factors is described in the methodology used in this credit rating action, if applicable.

Azerbaijan's Baa3 long-term issuer rating is below the final scorecard-indicated outcome of A3-Baa2. The positive outlook signals upward pressure on the issuer's creditworthiness, as explained above. The difference between the final scorecard-indicated outcome and the initial scorecard-indicated outcome of A1-A3 is driven by the country's limited, though improving, economic diversification alongside weaker innovative capacities and narrower economic complexity relative to peers. As a result, our final score for economic strength is "ba1", compared to a "baa2" initial score.

REGULATORY DISCLOSURES

The List of Affected Credit Ratings announced here are a mix of solicited and unsolicited credit ratings. For additional information, please refer to Moody's Policy for Designating and Assigning Unsolicited Credit Ratings available on its website https://ratings.moodys.com. Additionally, the List of Affected Credit Ratings includes additional disclosures that vary with regard to some of the ratings. Please click on this link https://www.moodys.com/viewresearchdoc.aspx?docid=PBC_ARFTL509518 for the List of Affected Credit Ratings. This list is an integral part of this Press Release and provides, for each of the credit ratings covered, Moody's disclosures on the following items:

Rating Solicitation

Issuer Participation

Participation: Access to Management

Participation: Access to Internal Documents

Endorsement

Lead Analyst

Releasing Office

For further specification of Moody's key rating assumptions and sensitivity analysis, see the sections Methodology Assumptions and Sensitivity to Assumptions in the disclosure form. Moody's Rating Symbols and Definitions can be found on https://ratings.moodys.com/rating-definitions.

For any affected securities or rated entities receiving direct credit support/credit substitution from another entity or entities subject to a credit rating action (the supporting entity), and whose ratings may change as a result of a credit rating action as to the supporting entity, the associated regulatory disclosures will relate to the supporting entity. Exceptions to this approach may be applicable in certain jurisdictions.

For ratings issued on a program, series, category/class of debt or security, certain regulatory disclosures applicable to each rating of a subsequently issued bond or note of the same series, category/class of debt, or security, or pursuant to a program for which the ratings are derived exclusively from existing ratings, in accordance with Moody's rating practices, can be found in the most recent Credit Rating Announcement related to the same class of Credit Rating.

For provisional ratings, the Credit Rating Announcement provides certain regulatory disclosures in relation to the provisional rating assigned, and in relation to a definitive rating that may be assigned subsequent to the final issuance of the debt, in each case where the transaction structure and terms have not changed prior to the assignment of the definitive rating in a manner that would have affected the rating.

Moody's does not always publish a separate Credit Rating Announcement for each Credit Rating assigned in the Anticipated Ratings Process or Subsequent Ratings Process.

Regulatory disclosures contained in this press release apply to the credit rating and, if applicable, the related rating outlook or rating review.

At least one ESG consideration was material to the credit rating action(s) announced and described above. Moody's general principles for assessing environmental, social and governance (ESG) risks in our credit analysis can be found at https://ratings.moodys.com/rmc-documents/435880.

Please see https://ratings.moodys.com for any updates on changes to the lead rating analyst and to the Moody's legal entity that has issued the rating.

Please see the issuer/deal page on https://ratings.moodys.com for additional regulatory disclosures for each credit rating.

Müştərilərin xəbərləri

Azercell Gənclər Günü ərəfəsində Beynəlxalq İnformatika Olimpiadası üzrə milli komanda ilə görüş keçirib

SON XƏBƏRLƏR

- 2 ay sonra

-

5 gün sonra

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

-

6 saat əvvəl

Qızıl Trampın FED sədri namizədliyindən sonra ucuzlaşmaqda davam edir

-

- 6 saat əvvəl

- 7 saat əvvəl

-

8 saat əvvəl

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

- 9 saat əvvəl

-

9 saat əvvəl

SOCAR ilə “Yokogawa Europe B.V.” şirkəti arasında Anlaşma Memorandumu imzalanıb

-

11 saat əvvəl

Ölkənin birinci bankı və birinci universiteti arasında memorandum imzalandı

-

12 saat əvvəl

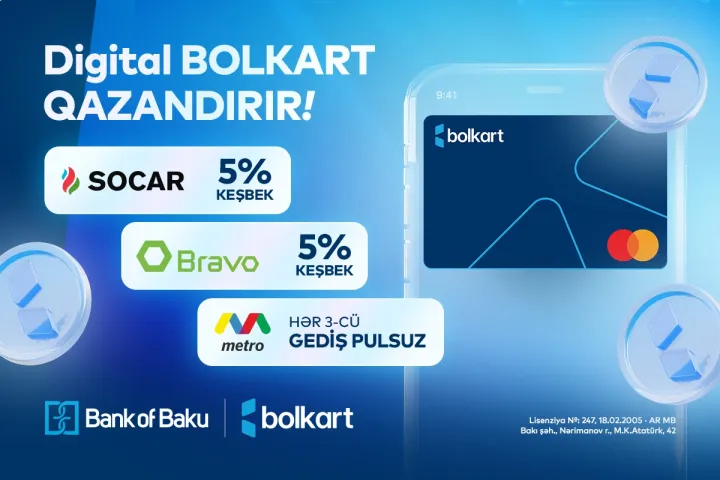

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

- 12 saat əvvəl

-

12 saat əvvəl

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

Son Xəbərlər

Azərbaycanda Vakansiyalar - Azvak.az

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

Bakıda daha bir "Pizza Hut" restoranı açılacaq

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

Ən çox oxunanlar

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

Dolların sabah üçün rəsmi məzənnəsi müəyyən olunub

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

İnnovasiya və Süni İntellekt” üzrə təqaüd proqramına qeydiyyat davam edir - Gənclərin nəzərinə

Prezident İlham Əliyev Birləşmiş Ərəb Əmirliklərinə səfərə gəlib

“InvestAZ”dan dünya maliyyə bazarları ilə bağlı həftəlik analiz