“Moody's” SOCAR-ın reytinqini yüksəldib

“Moody's Investors Service” (“Moody's”) beynəlxalq reytinq agentliyi Azərbaycan Dövlət Neft Şirkətinin (SOCAR) reytinqlərini korporativ ailə reytinqi (CFR) və yüksək təminatsız reytinqi də daxil olmaqla “Ba2”dən “Ba1”ə yüksəldib.

Eyni zamanda “Moody's” SOCAR-ın Əsas Kredit Qiymətləndirməsini (BCA) “b1”dən “ba3ə”, Defolt Ehtimalı Reytinqini (PDR) isə “Ba2-PD"dən “Ba1-PD”yə yüksəldib. Reytinq agentliyi həmçinin şirkətin reytinqləri üzrə proqnozunu "müsbət"dən "stabil"ə dəyişib.

Bugünkü reytinq qərarı avqustun 5-də Azərbaycanın suveren reytinqinin “Ba2”dən “Ba1”ə yüksəldilməsinə uyğundur.

XXX

Moody's upgrades SOCAR to Ba1 from Ba2; changes outlook to stable from positive

10 Aug 2022

London, August 10, 2022 -- Moody's Investors Service ("Moody's") has today upgraded the ratings of State Oil Company of the Azerbaijan Republic (SOCAR) to Ba1 from Ba2, including its corporate family rating (CFR) and senior unsecured rating. Concurrently, Moody's has upgraded SOCAR's baseline credit assessment (BCA) to ba3 from b1 and its probability of default rating (PDR) to Ba1-PD from Ba2-PD. The rating agency has also changed the company's outlook to stable from positive.

Today's rating action follows the upgrade of the ratings of the Government of Azerbaijan to Ba1 from Ba2 on 5 August 2022. For additional information, please refer to the related announcement: https://www.moodys.com/research/Moodys-upgrades-Azerbaijans-ratings-to-Ba1-outlook-changed-to-stable--PR_467873.

RATINGS RATIONALE

Today's rating action is in line with the sovereign rating action and reflects SOCAR's strong credit linkages with the state as well as its significant exposure to Azerbaijan's operating and macroeconomic environment.

The upgrade of Azerbaijan's ratings reflects improved policy effectiveness in recent years which translates into improved fiscal management and increased capacity to absorb future shocks. Despite the pandemic, fiscal metrics have remained strong and are improving quicker than expected thanks to prudent fiscal management amid an economic rebound and high hydrocarbon prices. Moody's expects the government's anti-inflation measures and the Central Bank of the Republic of Azerbaijan's (CBAR) proactive macroeconomic policy to contain inflation risks exacerbated by the Russia/Ukraine crisis. As a result, Moody's expects that operating and macroeconomic environment for SOCAR will gradually improve, supporting its credit profile.

Given that SOCAR is 100% state owned, Moody's applies its Government-Related Issuers (GRI) methodology to determine the company's CFR. SOCAR's Ba1 CFR incorporates (1) the company's BCA of ba3, which measures its standalone credit strength, excluding any extraordinary government support; (2) the Ba1 foreign currency rating of the Government of Azerbaijan, with a stable outlook; (3) the very high default dependence between the state and the company; and (4) the high probability of the government providing support to the company in the event of financial distress.

SOCAR's ba3 BCA and standalone credit quality is supported by (1) the company's key role in the oil and gas sector of Azerbaijan and its importance to the national economy; (2) SOCAR's sustainable hydrocarbon production volumes; (3) Moody's expectation that SOCAR's credit metrics will continue to strengthen in 2022 and 2023 on the back of a surge in oil and gas prices; (4) the company's adequate liquidity, underpinned by substantial cash balances and modest debt maturities in the next two to three years (excluding short-term debt for its trading activities which the company rolls over consistently); and (5) its close links with the Azerbaijan government, which has accumulated substantial reserves and should be in a position to provide financial support to the company if needed.

However, SOCAR's BCA also takes into account (1) the company's sizeable trading operations which reduce its consolidated margins, inflate leverage through the use of short-term debt and limit predictability of financial results because of the inherent volatility of these activities; (2) governance factors including SOCAR's complex organisational structure and lack of transparency and disclosure with regard to foreign assets and transactions with shares in various subsidiaries and affiliates and (3) moderate refinancing risk at SOCAR's subsidiary Petkim Petrokimya Holding A.S. (B2, Ratings Under Review).

ESG CONSIDERATIONS

In addition to governance factors mentioned above, SOCAR has highly negative exposure to environmental factors related to carbon transition risk and waste & pollution in particular as decarbonisation efforts and transition towards cleaner energy continues.

The company also has highly negative exposure to social factors, mainly driven by demographic & societal pressures and the push for responsible production, which are common for oil and gas companies.

Overall, the credit impact of these exposures is non-material because it is offset by the high probability of government support in the event of financial distress and the group's resilient balance sheet.

RATIONALE FOR THE STABLE OUTLOOK

The stable outlook on SOCAR's rating is in line with the stable outlook on Azerbaijan's sovereign rating and reflects Moody's view that the company's specific credit factors, including its operating and financial performance, market position and liquidity, will remain commensurate with its rating on a sustainable basis.

FACTORS THAT COULD LEAD TO AN UPGRADE OR DOWNGRADE OF THE RATINGS

Moody's could upgrade SOCAR's rating if it were to upgrade Azerbaijan's sovereign rating, provided there was no significant deterioration in the company's specific credit factors, including its operating and financial performance, market position, credit metrics and liquidity, and no weakening in the probability of extraordinary state support in the event of financial distress.

Conversely, Moody's could downgrade SOCAR's rating if (i) it were to downgrade Azerbaijan's sovereign rating, or (ii) there was evidence that the government's capacity and willingness to provide support to SOCAR were diminishing, or (iii) government actions significantly impaired SOCAR's credit profile (including unfavourable regulatory or tax changes, significant equity withdrawals, or increased exposure to domestic and international infrastructure projects of the state without funding support from it), or (iv) SOCAR's retained cash flow (RCF)/net debt declined below 20% and EBIT/interest expenses declined below 3.0x, both on a Moody's-adjusted and sustained basis, or (v) if its liquidity deteriorated significantly.

İllik 13.99%-dən 40 000 AZN-dək zaminsiz komissiyasız kredit!

© Report

Müştərilərin xəbərləri

SON XƏBƏRLƏR

- 1 həftə sonra

- 1 həftə sonra

- 2 gün sonra

-

-

7 saat əvvəl

70%-dək böyük endirimlər və hissəli ödəniş imkanları - “Yaşıl Günlər” kampaniyası

- 8 saat əvvəl

- 8 saat əvvəl

- 9 saat əvvəl

- 9 saat əvvəl

-

1 gün əvvəl

Birbank-la NFC ödənişləri tezliklə “Baku Bus”da: SINAQ mərhələsi başladı

-

2 gün əvvəl

"Top" tamamilə Kiyev və onun Avropa sponsorlarının tərəfindədir"

- 2 gün əvvəl

- 2 gün əvvəl

Son Xəbərlər

Biznesiniz üçün QISA NÖMRƏ (Ulduz nömrə) alın

Azərbaycanda Vakansiyalar - Azvak.az

Ödənişsiz investisiya seminarı: Yatırımda təcrübə qazan

Dekabrın 22-də gözlənilən hava şəraiti

Yeni m10kart - İstədiyin an, istədiyin yerdə ödə

"Top" tamamilə Kiyev və onun Avropa sponsorlarının tərəfindədir"

Dolların bazar ertəsi üçün rəsmi məzənnəsi müəyyən olunub

Bakcell-in lotereyasında 11-ci lüks avtomobil uduldu!

Nərimanovda premium mənzil arzulayanlar üçün 36 ayadək faizsiz kredit təklifi davam edir

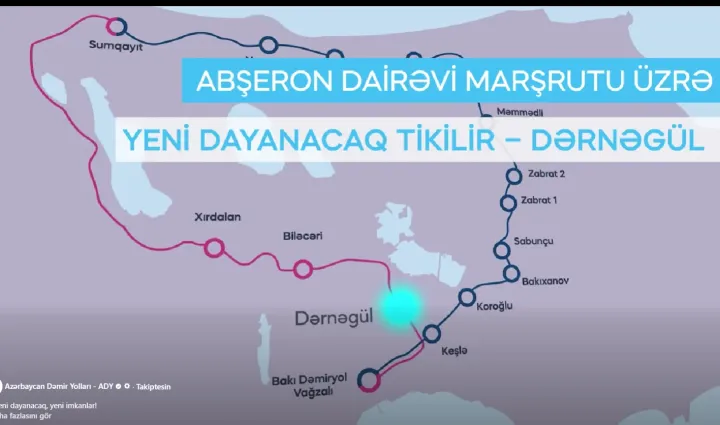

Azərbaycan Dəmir Yolları "Dərnəgül" dayanacağını tikir

.jpg)

.jpg)