“Fitch Ratings” Azərbaycanın kredit reytinqini təsdiqlədi

“Fitch Ratings” Azərbaycanın xarici valyutada uzunmüddətli emitent defoltu reytinqini ( Issuer Default Rating- IDR) “BBB-” səviyyəsində, "Sabit" proqnozla təsdiqləyib.

“Fitch Ratings” Azərbaycanın xarici valyutada uzunmüddətli emitent defoltu reytinqini (IDR) növbəti dəfə “BBB-” səviyyəsində təsdiqləyib. Proqnoz “Sabit”dir.

Bu barədə reytinq agentliyi məlumat yayıb.

Qeyd olunub ki, reytinq Azərbaycanın çox güclü xarici balansı, aşağı dövlət borcu və suveren fondun böyük aktivləri hesabına yüksək maliyyə çevikliyi ilə dəstəklənir.

“Fitch” təxmin edir ki, Azərbaycanın suveren xarici valyuta aktivləri (83%-i Azərbaycan Respublikası Dövlət Neft Fonduna (SOFAZ) məxsusdur, qalanı Azərbaycan Respublikası Mərkəzi Bankının ehtiyatlarındadır) 2024-cü ildə 76 milyard ABŞ dollarına (proqnozlaşdırılan ÜDM-in 102%-i) çatıb. Azərbaycanın suveren xarici aktivlərinin xalis mövqeyi, 2024-cü ildə ÜDM-in 71%-i olaraq təxmin edilir və bu, 'BBB' və 'A' suverenləri arasında ən yüksəkdir.

Fitch gözləyir ki, fiskal siyasət güclü suveren xarici aktivləri qorumaq və makroiqtisadi disbalansların yığılmasının qarşısını almaqla neft qiymətlərinin dəyişkənliyini idarə etmək üçün adekvat siyasət buferlərini qorumaqla uyğun olacaqdır.

Qeyd edək ki, “Fitch Ratings” Azərbaycanın xarici valyutada uzunmüddətli emitent defoltu reytinqini (IDR) 2024-cü ilin iyul ayında“BB+” səviyyəsindən “BBB-” səviyyəsinə yüksəldib.

XXX

Fitch Affirms Azerbaijan at 'BBB-'; Outlook Stable

Fitch Ratings - London - 17 Jan 2025: Fitch Ratings has affirmed Azerbaijan's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'BBB-' with a Stable Outlook.

A full list of rating actions is at the end of this rating action commentary.

Key Rating Drivers

Fundamental Credit Strengths and Weaknesses: Azerbaijan's ratings reflect a very strong external balance sheet, the lowest public debt in its peer group, and financing flexibility from large sovereign wealth fund assets. Set against these factors are weak governance indicators, a weak economic policy framework, heavy dependence on hydrocarbons, and geopolitical risks.

Robust External Balance Sheet: Fitch estimates that sovereign foreign-currency assets (83% held by the Sovereign Wealth Fund of Azerbaijan (SOFAZ) with the remainder in the Central Bank of the Republic of Azerbaijan's (CBRA) reserves) rose to USD76 billion (102% of estimated GDP) in 2024. Azerbaijan's net sovereign foreign asset position, estimated at 71% of GDP in 2024, is the highest among 'BBB' and 'A' sovereigns. Fitch expects fiscal policy will be consistent with maintaining robust sovereign external assets and avoiding the build-up of macroeconomic imbalances, preserving adequate policy buffers to manage oil price volatility.

Twin, Albeit Lower, Surpluses: The current account surplus halved to 6.5% of GDP in 2024, but remains the highest in the 'BB' category. Azerbaijan will maintain (high relative to peers) current account surpluses averaging (6.2% of GDP in 2025-2026), despite lower oil prices (oil and gas revenues account for 89% of total exports), supporting continued, albeit more moderate, FX assets accumulation. We estimate Azerbaijan's net external creditor position strengthened to 153% of GDP in 2024, the strongest among 'BBB' sovereigns.

We estimate the consolidated budget surplus declined sharply to 1% of GDP in 2024 (from 7.8% in 2023), reflecting strong expenditure growth partly balanced by non-oil revenue growth and returns on SOFAZ assets. We forecast the consolidated budget surplus will remain roughly stable in 2025-2026 as lower oil prices will be partly balanced by increases in non-oil revenue, partly derived from the end of pandemic-related tax relief. We also expect Karabakh-related expenditure to taper, but current expenditure pressures in terms of social spending and defence will likely prevent significant easing of spending.

Weak Policy Anchor: Azerbaijan maintains its policy objective to reduce public finances' dependence on oil and gas revenues, but Fitch considers that the fiscal rule has a limited record, and a weak institutional framework in terms of oversight and establishment of fiscal targets. Azerbaijan targets a 15.5% of GDP non-energy primary deficit by 2028 (estimated 21.4% in 2024). Achieving this will depend on the extent to which non-oil revenue growth can accommodate expenditure commitments related to Karabakh and defence. The government maintains the upper limit for government debt at 30% of GDP (increased in 2023) and the nominal ceiling on external debt of USD10 billion and SOFAZ assets at a stable level.

Low Government Debt: We estimate government debt reached 21.1% of GDP and approach 23.3% of GDP by 2026, one of the lowest among Fitch's investment-grade sovereigns. External debt has declined in absolute terms in recent years, currency composition has improved and about two-thirds of external debt is to official creditors. External government guarantees and on-lending declined to USD5.6billion (7.6% of 2024 estimated GDP), from USD6.4 billion in 2022, with 77% of these related to the Southern Gas Corridor project, which is profitable and not likely to require sovereign support.

Developing Monetary Policy: The CBRA uses the exchange rate as the intermediate operational target and since 2022 has improved its capacity to manage the banking system's structural liquidity surplus and increase transmission of the key policy rate. Monetary policy framework remains weak relative to peers and constrained by under-developed capital markets, excess liquidity, low financial intermediation and still relatively high financial dollarisation (39.4% in October 2024 but less than half the peak of 81.6% at end-2015).

Moreover, lack of institutional independence and clarity of mandates for the CBRA and SOFAZ within the broader exchange-rate framework persist. We consider there is still strong political prioritisation to maintain the de facto exchange rate peg to the US dollar, despite the authorities' stated aim of allowing greater flexibility in the medium term.

Inflation Uptick: Annual inflation increased (4.9% yoy in December), but remains within the CBRA's target band (4%±2pp). Average inflation will increase to 5.3%, up from estimated 2.1% in 2024, higher than the projected 3% for the 'BBB' median. The CBRA paused its easing cycle in May, and we do not expect additional rate cuts, given external uncertainty, increases to administered prices and the risk of domestic demand pressures from household and government consumption.

Cyclical Economic Rebound: Fitch estimates that growth accelerated to 4.1% in 2024 due to a slower decline in oil output and positive spill-overs from the reconstruction of Karabakh. We expect growth to slow to 3% in 2025 and 2.4% in 2026, still supported by public investment. The drag of the oil sector will ease relative to previous years, due to new oil production that could slow the pace of decline and higher natural gas production. Progress towards economic diversification is constrained by the large presence of the state, limited access to affordable financing, governance challenges and low non-energy foreign investment.

Continued Peace Agreement Negotiations: Azerbaijan and Armenia have reportedly reached agreement on certain key points for an eventual peace treaty including border delimitation. The flexibility and willingness from both parties to resolve the outstanding issues and the timing for a potential resolution remains uncertain. Fitch does not expect a fully-fledged military escalation of the conflict.

ESG - Governance: Azerbaijan has an ESG Relevance Score (RS) of '5' for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Azerbaijan has a low WBGI ranking at the 28 percentile, reflecting very poor voice and accountability, relatively weak rights for participation in the political process, uneven application of the rule of law and a high level of corruption.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

-Macro: A deterioration in the economic policy mix that, for example, results in heightened macroeconomic and financial stability risks and/or increases Azerbaijan's vulnerability to external shocks including oil price volatility.

-External/Fiscal Finances: Significant erosion of the sovereign balance sheet; for example, due to persistently lower commodity prices, a more rapid decline in hydrocarbons production or significant fiscal loosening.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

-Macro/Structural: Continued strengthening of the economic policy framework and institutional capacity that enhance Azerbaijan's capacity to absorb shocks.

-Structural/Macro: Successful implementation of structural reforms that supports improved governance and higher growth, especially if supported by progress towards economic diversification.

-External Finances: Significant additional strengthening of the sovereign balance sheet resulting, for example, from an extended period of higher energy revenues and maintenance of a relatively prudent policy mix.

Sovereign Rating Model (SRM) and Qualitative Overlay (QO)

Fitch's proprietary SRM assigns Azerbaijan a score equivalent to a rating of 'BB+' on the Long-Term Foreign-Currency (LT FC) IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM score to arrive at the final LT FC IDR by applying its QO, relative to SRM data and output, as follows:

- Macro: -1 notch, to reflect Azerbaijan's improving but relatively weak policy framework, including lack of institutional independence, limited clarity of mandates for the CBRA and SOFAZ in terms of FX policy and constraints to monetary policy effectiveness due to still developing transmission channels.

- Public Finances: +1 notch, to reflect the sovereign's enhanced financing flexibility and public debt sustainability derived from large SOFAZ assets and government deposits.

- External Finances: -+1 notch, to reflect large SOFAZ assets, which underpin Azerbaijan's exceptionally strong foreign-currency liquidity position and the country's very large net external creditor position.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

Country Ceiling

The Country Ceiling for Azerbaijan is 'BBB-' in line with the LT FC IDR. This reflects no material constraints and incentives, relative to the IDR, against capital or exchange controls being imposed that would prevent or significantly impede the private sector from converting local currency into foreign currency and transferring the proceeds to non-resident creditors to service debt payments.

Fitch's Country Ceiling Model produced a starting point uplift of +1 notch above the IDR. Fitch's rating committee applied an offsetting -1 notch qualitative adjustment to this, under the Balance of Payments Restrictions pillar reflecting still a strong political prioritisation to maintaining the 1.7 AZN/USD de facto exchange rate peg. Fitch considers that regulatory and administrative measures to manage FX demand could be introduced in the event of a shock. In 2016, authorities closed FX bureaus and attempted to introduce a FX transaction tax.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG Considerations

Azerbaijan has an ESG Relevance Score of '5' for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Azerbaijan has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Azerbaijan has an ESG Relevance Score of '5' for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Azerbaijan has a percentile rank below 50 for the respective Governance Indicators, this has a negative impact on the credit profile.

Azerbaijan has an ESG Relevance Score of '4' for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver. As Azerbaijan has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Azerbaijan has an ESG Relevance Score of '4+' for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver for Azerbaijan, as for all sovereigns. As Azerbaijan has track record of 20+ years without a restructuring of public debt and captured in our SRM variable, this has a positive impact on the credit profile.

Müştərilərin xəbərləri

Azercell Gənclər Günü ərəfəsində Beynəlxalq İnformatika Olimpiadası üzrə milli komanda ilə görüş keçirib

SON XƏBƏRLƏR

- 2 ay sonra

-

5 gün sonra

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

-

6 saat əvvəl

Qızıl Trampın FED sədri namizədliyindən sonra ucuzlaşmaqda davam edir

-

- 6 saat əvvəl

- 7 saat əvvəl

-

8 saat əvvəl

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

- 9 saat əvvəl

-

9 saat əvvəl

SOCAR ilə “Yokogawa Europe B.V.” şirkəti arasında Anlaşma Memorandumu imzalanıb

-

12 saat əvvəl

Ölkənin birinci bankı və birinci universiteti arasında memorandum imzalandı

-

12 saat əvvəl

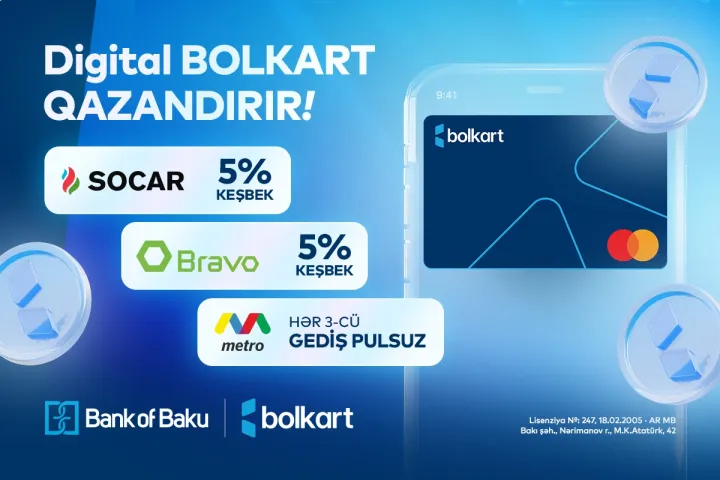

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

- 12 saat əvvəl

-

12 saat əvvəl

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

Son Xəbərlər

Azərbaycanda Vakansiyalar - Azvak.az

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

Bakıda daha bir "Pizza Hut" restoranı açılacaq

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

Ən çox oxunanlar

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

Dolların sabah üçün rəsmi məzənnəsi müəyyən olunub

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

İnnovasiya və Süni İntellekt” üzrə təqaüd proqramına qeydiyyat davam edir - Gənclərin nəzərinə

Prezident İlham Əliyev Birləşmiş Ərəb Əmirliklərinə səfərə gəlib

“InvestAZ”dan dünya maliyyə bazarları ilə bağlı həftəlik analiz