Azərbaycanın reytinqi "mənfi" proqnoz ilə saxlandı

28 iyul 2017-ci il tarixində “Standard ənd Purz” (Standard and Poor’s) reytinq agentliyi Azərbaycan Respublikasının suveren kredit reytinqinin ənənəvi qiymətləndirməsini aparmış və müvafiq hesabatını açıqlamışdır.

Maliyyə Nazirliyinin mətbuat xidmətindən "Marja"ya daxil olmuş məlumata görə, agentlik Azərbaycan Respublikasının uzunmüddətli və qısamüddətli xarici və milli valyutada suveren kredit reytinini dəyişməyərək müvafiq olaraq 'BB+/B' səviyyəsində, "mənfi" proqnoz ilə saxlamışdır.

“Standard ənd Purz” reytinq agentliyinin yaydığı son hesabatda reytinqin dəyişməz olaraq saxlanılmasına əsas səbəb kimi ölkənin möhkəm fiskal mövqeyi, xüsusiylə Azərbaycan Respublikası Dövlət Neft Fondunun xarici valyutada ehtiyyatlarının mövcudluğu göstərilir.

Agentlik hesab edir ki, tədiyə balansına olan təzyiqlərin aradan qalxacağı, ölkənin iqtisadi inkişaf göstəricilərinin gözlənilən artımı və daxili bank sistemində sabitliyin möhkəmlənməsi nəticəsində reytinq üzrə proqnoz mənfidən müsbətə keçirilə bilər.

OVERVIEW

Azerbaijan's economy is slowly recovering from the 2014-2015 terms of

trade shock.

The government's fiscal and foreign exchange buffers remain significant.

We are affirming our 'BB+/B' ratings on Azerbaijan.

The negative outlook reflects the risks of the country's external

performance becoming weaker than in our baseline forecast over the next

six to 12 months.

RATING ACTION

On July 28, 2017, S&P Global Ratings affirmed its long- and short-term foreign

and local currency sovereign credit ratings on the Republic of Azerbaijan at

'BB+/B'. The outlook for the long-term ratings remains negative.

OUTLOOK

The negative outlook primarily reflects the risks of Azerbaijan's external

performance being weaker than in our baseline forecast over the next six to 12

months.

We could lower the ratings if:

Balance of payments pressures do not recede, leading, for example, to a

further decline in central bank reserves or accumulated savings in

Azerbaijan's Oil Fund (SOFAZ); or

The government's fiscal flexibility is reduced, for instance because

containing spending becomes challenging for political reasons.

We could revise the outlook to stable if balance of payments pressures abated

while the country's growth prospects and domestic banking system stability

improved.

RATIONALE

Our ratings on Azerbaijan are primarily supported by the sovereign's strong

fiscal position, underpinned by the large stock of foreign assets accumulated

in the sovereign wealth fund, SOFAZ. The ratings are constrained by weak

institutional effectiveness, the narrow and concentrated economic base, and

limited monetary policy flexibility.

Institutional and Economic Profile:Adjustment to lower commodity prices

continues but growth is set to gradually strengthen

We expect Azerbaijan to experience a second year of recession with output

contracting by 1% in 2017.

Economic performance should gradually strengthen thereafter but still

remain below that of other countries at a similar level of economic

development.

Azerbaijan's institutional arrangements remain weak and we expect limited

progress on the structural reform front over the next few years.

This year, Azerbaijan's economy has continued to adjust to lower commodity

prices. More than a year after the devaluation of the manat, the repercussions

are still being felt, not least in Azerbaijan's weakened financial sector.

We forecast the Azerbaijani economy will remain in recession in 2017 with

output projected to contract by 1% in real terms, after contracting by just

over 3% in 2016, as the devaluation of the manat and public spending cuts

constrained demand and confidence.

We project investment will begin to recover this year owing to the ongoing

work on the Southern Gas Corridor project, which is intended to bring Azeri

gas from the offshore Shah Deniz Stage II gas field (SDII) in the Caspian

first to Turkey at the end of 2018 and eventually to Europe by 2020. At the

same time, we anticipate that consumption growth will be lacklustre reflecting

elevated inflation, and the rise in precautionary savings. We also expect

exports to contract this year in real terms owing to both Azerbaijan's

participation in OPEC output cuts and the natural aging of the country's

oilfields. We understand that, absent sustained investment, oil production

will likely decline gradually over our four-year forecast horizon.

We expect the economy will turn the corner in 2018 with growth strengthening

further and reaching 3.5% in 2019. The launch of new gas exports from SDII is

the key factor underpinning this forecast. Additionally, we consider that

consumption and non-hydrocarbon-related investments should post a stronger

performance as confidence improves and inflation subsides.

Still, even with the launch of the large SDII field, we expect Azerbaijan's

growth to lag that of countries at a similar level of economic development

over the next few years. At present, gas exports account only for an estimated

2% of total exports. Even as production is expanded threefold, this is

unlikely to bring back the pre-2008 growth rates that emerged on the back of

rapid expansion of oil output at the time.

More generally, we believe that at a time of lower and more volatile oil

prices, the economic outlook for heavily commodity-reliant Azerbaijan will

depend on the authorities' reform agenda, including efforts to improve the

business environment and ultimately diversify the economy away from

commodities. At present, we do not expect significant progress on the

structural reform front.

We view Azerbaijan's institutional arrangements as weak, characterized by

highly centralized decision-making, which lacks transparency and makes future

policy responses difficult to predict. Political power remains concentrated

around the President and his administration, with limited checks and balances

in place. The referendum in September 2016, followed by amendments to

Azerbaijan's constitution, has further centralized the president's power, in

our view.

Flexibility and Performance Profile: The balance sheet is strong but balance

of payments vulnerabilities persist

A strong fiscal position is the main factor supporting the ratings.

Nevertheless, net debt has risen rapidly reflecting the materialization of

contingent liabilities at International Bank of Azerbaijan (IBA).

External position remains strong on a stock basis but downside risks

persist.

Monetary policy effectiveness is limited.

Azerbaijan's strong fiscal position remains the main factor supporting the

sovereign ratings. It is underpinned by the large foreign assets accumulated

in the sovereign wealth fund SOFAZ. We forecast these will amount to about 80%

of GDP at year-end 2017, and the sovereign will remain in a net asset position

averaging 40% of GDP over the four-year forecast horizon.

Even though the sovereign balance sheet is still strong, fiscal pressures

remain elevated. We forecast that the consolidated budget will post a deficit

of 3.2% of GDP in 2017, following deficits averaging 3% in 2015-2016. This

compares to a decade of average fiscal surpluses of almost 7% of GDP. The

projected deterioration of fiscal performance this year primarily reflects the

one-off transfer from the country's sovereign wealth fund SOFAZ to the Central

Bank of Azerbaijan (CBA), which has previously spent most of its reserves

defending the peg that was later abandoned. We understand that this transfer

is needed to underpin confidence and arrest the balance of payments crisis of

2015-2016.

Net of the transfer to CBA, we estimate the consolidated budget at close to

balance. We note the high fiscal flexibility on the expenditure side

reflecting both the high level of capital spending and the government's

willingness to quickly adjust spending when required. This has prevented the

fiscal flow performance from weakening further over the last two years.

Looking ahead, budgetary outcomes will also be supported by the weaker

exchange rate, launch of gas exports from SDII, and some recovery in oil

prices. The latter should be particularly important as Azerbaijan's government

revenues remain substantially dependent on the hydrocarbon sector. Still, we

continue to see downside risks to fiscal performance and flexibility,

particularly if keeping expenditures under control becomes difficult for

social or political reasons given the already sharp adjustment in living

standards.

Importantly, however, general government debt has expanded at a considerably

faster pace than the headline deficits imply over the last two years. This is

primarily due to the materialization of contingent liabilities in the banking

system: the government has contributed substantial resources to the majority

state-owned International Bank of Azerbaijan in 2016. In May 2017, the bank

announced its intention to undertake a debt restructuring to address its weak

financial position (see "Azerbaijan 'BB+/B' Ratings Affirmed Following

Announced IBA Debt Exchange; Outlook Remains Negative," published May 26,

2017).

On July 18, the proposed exchange was approved by the creditors. In line with

our previous expectations, the government will therefore assume additional net

debt of roughly 9% of GDP in relation to IBA--6% due to the direct assumption

of IBA's foreign liabilities, and another 3% from SOFAZ's deposit at IBA,

which we now exclude from our calculation of government liquid assets.

We do not expect IBA's debt exchange to lead to broader repercussions for

other banks. Still, we believe that the domestic banking system remains weak

and vulnerable to difficult economic conditions. The CBA reports nonperforming

loan levels of close to 12% as of May 2017 but we consider this to be an

underestimate, with the actual amount of toxic assets being higher.

Mirroring the developments on the fiscal side, Azerbaijan's external position

remains strong on a stock basis, and we expect the country's liquid external

assets to exceed external debt for the foreseeable future. Nevertheless,

Azerbaijan's net external asset position (external assets net of external

liabilities) is weakening and could decline to a level insufficient to fully

mitigate the risks from its volatile export revenue base, constraining the

government's ability to respond to potential adverse shocks in the future.

We currently project a gradual improvement in external flows, which should

help arrest the decline in accumulated buffers. However, if that does not

happen, ratings pressure could emerge. This could result from a combination of

weaker-than-projected oil prices and delays in the SDII gas project launch,

among other factors. We also note the only limited available data for

Azerbaijan's balance of payments and international investment position, which

possibly leads to an underestimation of external risks.

Our ratings on Azerbaijan remain constrained by the limited effectiveness of

its monetary policy. We believe that the increased flexibility of the manat

exchange rate has helped lessen external pressures and husband foreign

exchange reserves.

At the same time, apart from setting the country's foreign exchange regime and

undertaking interventions, the CBA's ability to influence economic

developments remains considerably constrained. We estimate that the resident

deposit dollarization remains at over 60%, which in our view severely limits

the CBA's attemp to influence domestic monetary conditions. In addition,

Azerbaijan's local currency debt capital market remains small and

underdeveloped, while CBA's operational independence remains limited.

KEY STATISTICS

Table 1

Republic of Azerbaijan Selected Indicators | ||||||||||

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

ECONOMIC INDICATORS (%) | ||||||||||

Nominal GDP (bil. LC) | 52 | 55 | 58 | 59 | 54 | 60 | 69 | 75 | 82 | 89 |

Nominal GDP (bil. $) | 66 | 70 | 74 | 75 | 53 | 38 | 40 | 44 | 47 | 48 |

GDP per capita (000s $) | 7.2 | 7.5 | 7.9 | 7.9 | 5.5 | 3.9 | 4.0 | 4.4 | 4.7 | 4.8 |

Real GDP growth | 0.1 | 2.2 | 5.8 | 2.8 | 1.1 | (3.1) | (1.0) | 2.0 | 3.5 | 3.5 |

Real GDP per capita growth | (1.2) | 0.8 | 4.4 | 1.5 | (0.1) | (4.2) | (2.2) | 0.8 | 2.3 | 2.3 |

Real investment growth | 12.0 | 2.2 | 19.4 | 1.4 | 2.0 | (15.0) | 5.5 | 3.5 | 2.5 | 2.5 |

Investment/GDP | 20.3 | 22.3 | 25.7 | 26.6 | 27.9 | 26.3 | 25.4 | 25.1 | 24.3 | 23.7 |

Savings/GDP | 46.3 | 43.8 | 42.2 | 40.2 | 27.5 | 22.7 | 24.5 | 25.3 | 26.4 | 26.1 |

Exports/GDP | 56.4 | 53.0 | 48.4 | 43.3 | 37.8 | 46.5 | 46.5 | 46.0 | 47.6 | 47.1 |

Real exports growth | 3.6 | 2.2 | 1.5 | (1.1) | (0.5) | (1.4) | (3.5) | 2.0 | 4.0 | 4.0 |

Unemployment rate | 5.4 | 5.2 | 5.0 | 4.9 | 5.0 | 5.5 | 6.0 | 5.5 | 5.0 | 5.0 |

EXTERNAL INDICATORS (%) | ||||||||||

Current account balance/GDP | 26.0 | 21.5 | 16.5 | 13.6 | (0.4) | (3.6) | (0.9) | 0.3 | 2.1 | 2.4 |

Current account balance/CARs | 42.9 | 37.6 | 31.7 | 28.3 | (1.0) | (7.1) | (1.8) | 0.6 | 3.9 | 4.6 |

CARs/GDP | 60.6 | 57.1 | 52.1 | 47.9 | 42.4 | 50.5 | 51.6 | 51.4 | 52.8 | 52.4 |

Trade balance/GDP | 36.6 | 31.4 | 27.8 | 25.2 | 11.0 | 11.1 | 12.3 | 12.7 | 14.3 | 14.8 |

Net FDI/GDP | 1.4 | 1.2 | 1.5 | 3.2 | 1.6 | 5.1 | 2.0 | 2.0 | 1.0 | 1.0 |

Net portfolio equity inflow/GDP | (0.0) | 0.0 | 0.0 | 0.0 | 0.0 | (0.0) | 0.0 | (2.0) | (2.0) | (2.0) |

Gross external financing needs/CARs plus usable reserves | 56.4 | 56.5 | 60.2 | 61.3 | 78.5 | 107.3 | 104.1 | 90.8 | 87.9 | 85.1 |

Narrow net external debt/CARs | (80.3) | (92.3) | (101.4) | (99.5) | (109.1) | (105.8) | (101.9) | (90.5) | (87.0) | (87.8) |

Net external liabilities/CARs | (70.2) | (80.3) | (88.3) | (78.7) | (72.4) | (53.8) | (50.3) | (45.8) | (47.7) | (52.2) |

Short-term external debt by remaining maturity/CARs | 8.4 | 9.0 | 10.1 | 13.6 | 25.5 | 28.3 | 22.5 | 14.4 | 14.1 | 13.9 |

Usable reserves/CAPs (months) | 3.4 | 5.1 | 5.3 | 6.6 | 7.3 | 2.9 | 2.3 | 3.1 | 3.2 | 3.6 |

Usable reserves (mil. $) | 10,482 | 11,695 | 14,152 | 13,758 | 5,017 | 3,974 | 5,757 | 6,287 | 7,223 | 8,192 |

FISCAL INDICATORS (%, General government) | ||||||||||

Balance/GDP | 10.9 | 4.1 | 1.7 | 2.8 | (4.9) | (1.2) | (3.2) | 1.0 | 2.5 | 2.5 |

Change in debt/GDP | 0.9 | 1.1 | 0.7 | 2.2 | 13.4 | 13.5 | 6.6 | 1.1 | 0.7 | 1.2 |

Primary balance/GDP | 11.2 | 4.4 | 1.9 | 3.0 | (4.6) | (0.8) | (2.6) | 1.7 | 3.2 | 3.1 |

Revenue/GDP | 44.6 | 40.8 | 39.9 | 39.1 | 33.9 | 34.3 | 33.0 | 31.0 | 30.0 | 30.0 |

Expenditures/GDP | 33.7 | 36.7 | 38.2 | 36.3 | 38.7 | 35.5 | 36.2 | 30.0 | 27.5 | 27.5 |

Interest /revenues | 0.6 | 0.6 | 0.6 | 0.4 | 0.9 | 1.3 | 2.0 | 2.3 | 2.3 | 2.2 |

Debt/GDP | 4.9 | 5.8 | 6.1 | 8.2 | 22.3 | 33.6 | 36.1 | 34.1 | 32.1 | 30.7 |

Debt/Revenue | 11.0 | 14.2 | 15.4 | 21.1 | 65.9 | 98.0 | 109.3 | 110.0 | 106.9 | 102.5 |

Net debt/GDP | (44.7) | (47.2) | (47.6) | (43.8) | (74.9) | (60.7) | (42.1) | (38.6) | (40.0) | (40.3) |

Liquid assets/GDP | 49.6 | 53.0 | 53.8 | 52.1 | 97.2 | 94.3 | 78.2 | 72.7 | 72.1 | 71.1 |

MONETARY INDICATORS (%) | ||||||||||

CPI growth | 7.9 | 1.1 | 2.4 | 1.4 | 4.0 | 12.4 | 9.0 | 7.0 | 5.0 | 5.0 |

GDP deflator growth | 22.6 | 2.8 | 0.5 | (1.3) | (8.9) | 14.6 | 15.0 | 7.0 | 5.0 | 5.0 |

Exchange rate, year-end (LC/$) | 0.79 | 0.79 | 0.78 | 0.78 | 1.56 | 1.77 | 1.70 | 1.70 | 1.79 | 1.87 |

Banks' claims on resident non-gov't sector growth | 10.3 | 27.6 | 18.0 | 24.2 | 16.5 | (21.1) | (15.0) | 0.0 | 5.0 | 5.0 |

Banks' claims on resident non-gov't sector/GDP | 19.1 | 23.2 | 25.7 | 31.5 | 39.8 | 28.3 | 21.1 | 19.3 | 18.7 | 18.1 |

Foreign currency share of claims by banks on residents | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Foreign currency share of residents' bank deposits | 43.1 | 39.6 | 32.9 | 36.2 | 76.4 | 64.4 | N/A | N/A | N/A | N/A |

Real effective exchange rate growth | 5.1 | (2.9) | 0.9 | 11.5 | (25.0) | (17.0) | N/A | N/A | N/A | N/A |

Savings is defined as investment plus the current account surplus (deficit). Investment is defined as expenditure on capital goods, including plant, equipment, and housing, plus the change in inventories. Banks are other depository corporations other than the central bank, whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private- sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial-sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. LC--Local currency. CARs--Current account receipts. FDI--Foreign direct investment. CAPs--Current account payments. The data and ratios above result from S&P Global Ratings' own calculations, drawing on national as well as international sources, reflecting S&P Global Ratings' independent view on the timeliness, coverage, accuracy, credibility, and usability of available information. | ||||||||||

RATINGS SCORE SNAPSHOT

Müştərilərin xəbərləri

Azercell Gənclər Günü ərəfəsində Beynəlxalq İnformatika Olimpiadası üzrə milli komanda ilə görüş keçirib

SON XƏBƏRLƏR

- 2 ay sonra

-

5 gün sonra

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

-

8 saat əvvəl

Qızıl Trampın FED sədri namizədliyindən sonra ucuzlaşmaqda davam edir

-

- 8 saat əvvəl

- 8 saat əvvəl

-

10 saat əvvəl

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

- 10 saat əvvəl

-

11 saat əvvəl

SOCAR ilə “Yokogawa Europe B.V.” şirkəti arasında Anlaşma Memorandumu imzalanıb

-

13 saat əvvəl

Ölkənin birinci bankı və birinci universiteti arasında memorandum imzalandı

-

13 saat əvvəl

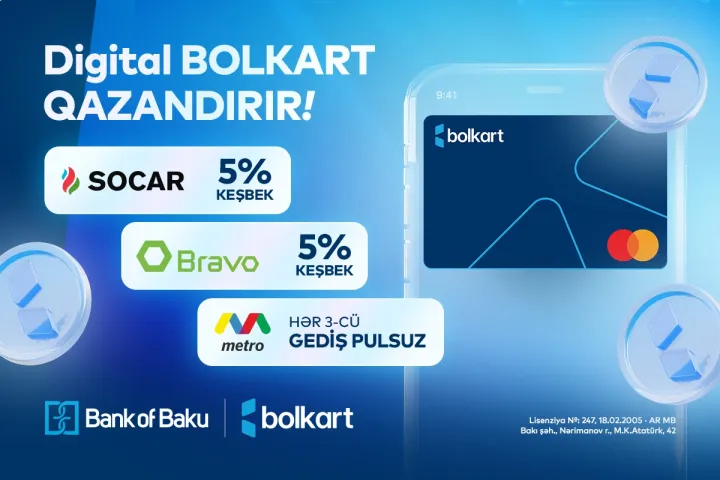

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

- 13 saat əvvəl

-

14 saat əvvəl

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

Son Xəbərlər

Azərbaycanda Vakansiyalar - Azvak.az

Yalnız yağın ödənişini edin — Filtr və işçilik bizdən hədiyyə!

Bakıda daha bir "Pizza Hut" restoranı açılacaq

Azərbaycan “Cənub Qaz Dəhlizi”nin bir hissəsini ərəblərin şirkətinə satdı - MÜQAVİLƏ İMZALANDI

Ən çox oxunanlar

Bank of Baku-nun Mastercard Digital Bolkart kartı qazandırır - 5% KEŞBEK və PULSUZ GEDİŞLƏR!

Dolların sabah üçün rəsmi məzənnəsi müəyyən olunub

Tesla-nın Avropadakı satışlarında azalma 2026-cı ildə də davam edir

İnnovasiya və Süni İntellekt” üzrə təqaüd proqramına qeydiyyat davam edir - Gənclərin nəzərinə

Prezident İlham Əliyev Birləşmiş Ərəb Əmirliklərinə səfərə gəlib

“InvestAZ”dan dünya maliyyə bazarları ilə bağlı həftəlik analiz